Are you curious about the job market trends for the first quarter of 2024? If so, you’ll be interested in our analysis of the first quarter Bureau of Labor Statistics (BLS) Employment Situation reports, containing valuable insights into employment trends from January through March.

Our comprehensive report aims to thoroughly examine the data, shedding light on industry-specific developments and their implications for job seekers and hiring managers. From examining job creation patterns to wage fluctuations, we aim to equip our audience with actionable intelligence to navigate the evolving employment landscape.

Join us as we explore the intricacies of the first quarter Employment Situation Jobs Report, analyzing the data to offer strategic insights for informed decision-making.

General Market Trend Breakdown

Over the past seven months, the unemployment rate has remained relatively steady, fluctuating between 3.7 percent and 3.9 percent since August 2023. This continuation signifies a resilient labor market, fostering an atmosphere conducive to both job seekers and employers. This trend persisted throughout the first quarter of 2024, with January registering a rate of 3.7 percent, February at 3.9 percent, and March at 3.8 percent. This consistency highlights the stability of the employment landscape, offering assurance amidst economic uncertainties.

Shifting focus to total nonfarm payroll employment metrics, the first quarter of 2024 was marked by a steady surge in job creation. January saw the addition of 256,000 new jobs, followed by February’s 270,000 and March’s impressive swell of 303,000. This quarterly average of 276,300 new jobs represents a significant upswing compared to the preceding quarter, which only saw an average of 164,000 new jobs per month. This acceleration in employment growth is a clear indicator of an optimistic economy fueled by factors such as increased consumer spending and business confidence.

Another component of the current economic outlook is the continual rise in average hourly earnings. January recorded earnings of $34.20 per hour, February at $34.30 per hour, and March at $34.40 per hour. This quarterly average of $34.30 per hour represents a discernible improvement from the preceding quarter’s average of $34.13 per hour. Above all, over the past 12 months, average hourly earnings have experienced a commendable growth rate of 4.1 percent. This surge not only reflects positive momentum in wage growth but also underscores the potential enhancement of living standards for workers across various sectors.

Industry-Focused Digest

In their monthly assessments, the Bureau of Labor Statistics (BLS) zeroes in on industries experiencing notable job expansion, providing detailed insights into the specific areas within these sectors witnessing employment growth. Auditing the first quarter of 2024 reports reveals standout industry highlights that deserve attention and recognition.

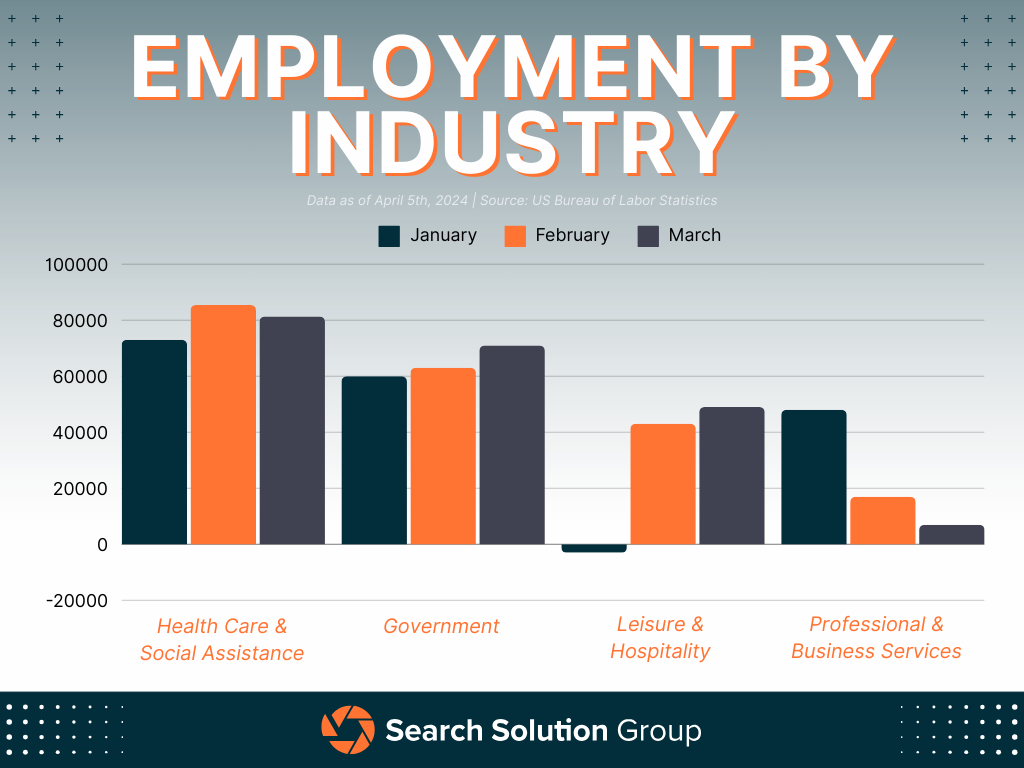

Starting with Health Care & Social Assistance, it exhibited consistent growth, adding 73,000 new jobs in January, 85,400 in February, and 81,300 in March. The cumulative total for Q1 was 239,700 new jobs, averaging 79,900 new jobs per month. This powerful performance surpasses the Q4 2023 average of 76,000 new jobs monthly, indicating sustained demand for healthcare and social assistance professionals.

In contrast, the Government sector saw substantial expansion, with January, February, and March adding 60,000, 63,000, and 71,000 new jobs, respectively. The Q1 total stood at 194,000 new jobs, averaging 64,666 new jobs per month, a notable increase from the Q4 2023 average of 50,600 new jobs per month. This uptick reflects growing public sector initiatives and investments.

The Leisure & Hospitality industry experienced mixed fortunes, witnessing a decline of 3,000 jobs in January, followed by substantial gains of 43,000 and 49,000 jobs in February and March, respectively. The Q1 total reached 296,666 new jobs, averaging 89,000 new jobs per month, a considerable leap from the Q4 2023 average of 33,000 new jobs per month. Despite initial setbacks, this sector demonstrated resilience and recovery.

Lastly, the Professional & Business Services sector experienced fluctuations, with 48,000 new jobs in January, 17,000 in February, and 7,000 in March. The Q1 total stood at 72,000 new jobs, averaging 24,000 new jobs per month, compared to the Q4 2023 average of 2,000 new jobs per month. While exhibiting variability, this sector maintains a pivotal role in driving economic growth and innovation.

The industry-focused digest stresses the diverse dynamics at play within different sectors of the economy during the first quarter of 2024. Despite external uncertainties, several industries demonstrated resilience and growth, presenting opportunities for both job seekers and employers to capitalize on emerging trends and demands.

Key Takeaways

As we analyze the Q1 2024 Employment Situation Jobs Reports alongside our insights, several key takeaways emerge:

Job Seekers:

- Stability in Employment Landscape: The consistent unemployment rate, maintaining a range between 3.7 percent and 3.9 percent since August 2023 and continuing throughout the first quarter of 2024, signals a stable job market. Job seekers can find reassurance in this stability, indicating steady opportunities across various industries.

- Abundant Job Opportunities: The steady surge in Total Nonfarm Payroll Employment, with significant job gains recorded in January, February, and March, averaging 276,300 new jobs per month in the first quarter, reflects an economy poised for growth. This abundance of job opportunities presents job seekers with diverse career advancement and exploration options.

- Promising Wage Growth: The continuous increase in average hourly earnings and a notable growth rate of 4.1 percent over the past 12 months signifies positive momentum in wage growth. Job seekers can anticipate improved earning potential and potentially enhanced living standards as they navigate the job market.

Hiring Managers:

- Understanding Stability: In an economy experiencing low unemployment rates, the challenge of finding elite talent through the traditional job market intensifies. As fewer individuals are actively looking for jobs, the overall quality of job applicants tends to decrease, complicating the recruitment process for hiring managers and HR departments. Simply posting job vacancies is often insufficient to attract the best candidates. Consequently, a more proactive approach is essential. Many organizations find success in headhunting professionals who are already employed but may be open to switching positions if the right opportunity presents itself. To facilitate this, they frequently engage specialized search firms equipped with the necessary expertise and networks to pinpoint and draw in high-caliber talent who might not be actively job hunting. This strategy allows companies to stay competitive by ensuring they hire the most adept and fitting individuals in a competitive labor market.

- Responding to Increased Demand: The steady surge in Total Nonfarm Payroll Employment, with significant job gains recorded in January, February, and March, averaging 276,300 new jobs per month in the first quarter, highlights increased demand for talent across various industries. Hiring managers must adapt recruitment strategies to attract and retain top talent amidst heightened competition.

- Reviewing Compensation Packages: The continuous increase in average hourly earnings and a notable growth rate over the past 12 months emphasize the importance of reviewing compensation packages. Hiring managers may need to adjust wages and benefits to remain competitive in attracting and retaining skilled professionals.

Both job seekers and employers must remain updated on economic trends and leverage data to inform their decisions. Given the dynamic nature of the job market, it’s crucial to adapt strategies in response to shifting landscapes.

Upcoming BLS Reports for the First Quarter

The job market is in a constant state of flux, continually shaped by emerging trends and developments. The monthly Employment Situation Jobs Report provides an initial snapshot, but it only scratches the surface. Over the next few months, the Bureau of Labor Statistics will release a series of in-depth reports about the job market dynamics of the fourth quarter. Looking to stay informed and ahead of the curve? Pay close attention to these upcoming detailed analyses:

Friday, April 19th – State Employment and Unemployment for March 2024

Tuesday, April 30th – Employment Cost Index for First Quarter 2024

Wednesday, May 1st – Job Openings and Labor Turnover Survey for March 2024

Thursday, May 2nd – Productivity and Cost for First Quarter 2024

Friday, May 17th – State Job Openings and Labor Turnover for March 2024

If you found our analysis of the BLS Q1 Employment Situation Report insightful, let us help you navigate the complexities of hiring in today’s market. Reach out to our expert team at Search Solution Group for tailored solutions that meet all your recruitment needs. Together, we can build a workforce that not only meets but exceeds your expectations. Contact us today to get started!