The Bureau of Labor Statistics released its Employment Situation Report on Friday, September 6th, 2024, providing a comprehensive look at the U.S. labor market for August. The report reflects a mixed economic picture, with job growth continuing at a slower pace than in previous months and unemployment levels stabilizing but remaining higher than a year ago. Sectors like construction and health care demonstrated strength, while manufacturing saw a notable decline, and other key industries showed little to no change in employment.

Economists had predicted stronger results, with expectations of 160,000 new jobs and a slight decrease in the unemployment rate. However, the data points to a more modest economic expansion, with hiring coming in slightly below expectations and wages showing continued growth. Here’s a breakdown of the report’s key findings:

Nonfarm Payroll Employment

In August, the U.S. economy added 142,000 jobs, maintaining the general trend seen in recent months but falling below the average monthly gain of 202,000 jobs from the past year. This is a significant slowdown in hiring compared to earlier periods and reflects ongoing concerns about the economic outlook as businesses adapt to a shifting market.

Notable Job Gains: Job growth was concentrated in construction and health care, which saw some of the largest employment increases.

Sector-Specific Details:

- Construction: Gained 34,000 jobs, surpassing its 12-month average of 19,000 jobs per month, signaling continued demand in the building sector.

- Health Care: Added 31,000 jobs, though below its average monthly gain of 60,000, indicating slower growth in the typically strong sector.

- Social Assistance: Increased by 13,000 jobs, slightly under its average gain of 21,000, showing steady, though modest, progress.

- Manufacturing: Suffered a decline of 24,000 jobs, marking a significant slowdown in an industry that had previously shown resilience.

Other industries, including mining, wholesale trade, retail trade, transportation and warehousing, financial activities, and professional services, saw little change, indicating a broad stagnation in hiring across these sectors.

Unemployment

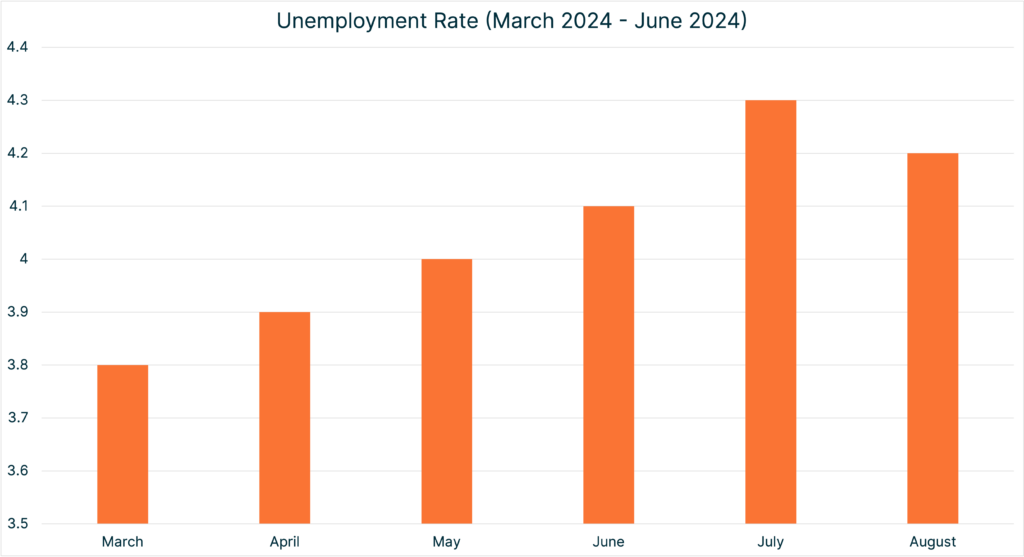

The unemployment rate held steady at 4.2%, with 7.1 million unemployed. This is higher than a year ago when the unemployment rate was 3.8%, and there were 6.3 million unemployed individuals. While the jobless rate has not fluctuated significantly in recent months, the increase over the past year reflects the challenges some sectors face in regaining pre-pandemic employment levels. Economists had anticipated a slight drop in the unemployment rate, but the current data suggests that recovery remains uneven across industries.

Average Hourly Earnings:

Wage growth remained solid, with average hourly earnings for all employees on private nonfarm payrolls rising by 14 cents (or 0.4%) to $35.21. Over the past 12 months, hourly earnings have grown by 3.8%, continuing the trend of moderate wage increases. While this rise in wages is positive for workers, businesses and policymakers will closely watch it, as it could influence inflationary pressures in the broader economy.

Overall Takeaway:

The August jobs report paints a picture of a labor market that is steady but showing signs of cooling, with growth slowing compared to earlier in the year. While job gains continue, particularly in construction and health care, the growth rate is below the 12-month average, and the unemployment rate remains higher than a year ago.

The construction sector’s strong gains are a positive sign for the housing and infrastructure markets, indicating continued demand despite economic uncertainty. However, the healthcare sector, which has been a consistent driver of job growth, saw a smaller-than-average increase in August, reflecting potential slowdowns as the sector faces challenges like rising costs and staffing shortages.

The manufacturing sector’s significant job losses highlight the challenges facing industries tied to production, where economic pressures such as higher material costs and global trade disruptions are dampening demand. The wage growth seen in August is another bright spot, suggesting that businesses are still willing to raise pay to attract and retain talent, although wage growth may add to inflationary concerns.

Overall, the report suggests a labor market in transition—one that continues to add jobs but at a slower pace, with varying performance across different sectors. The sustained rise in hourly earnings is a positive sign for workers, but concerns about inflation, particularly in key sectors like manufacturing, could dampen the pace of recovery. As the economy continues to face headwinds, the coming months will be critical in determining whether the labor market can maintain its current trajectory or if further slowdowns are on the horizon.

Looking to stay ahead in today’s shifting job market? Whether you’re in need of top-tier talent or seeking your next career opportunity, Search Solution Group has the expertise and industry knowledge to help you succeed. With over 20 years of experience and a proven track record in executive search, permanent placement, and contract staffing, we provide personalized recruitment solutions to meet your unique needs. Contact us today to learn how we can help you navigate the evolving employment landscape and find the perfect fit for your business or career.